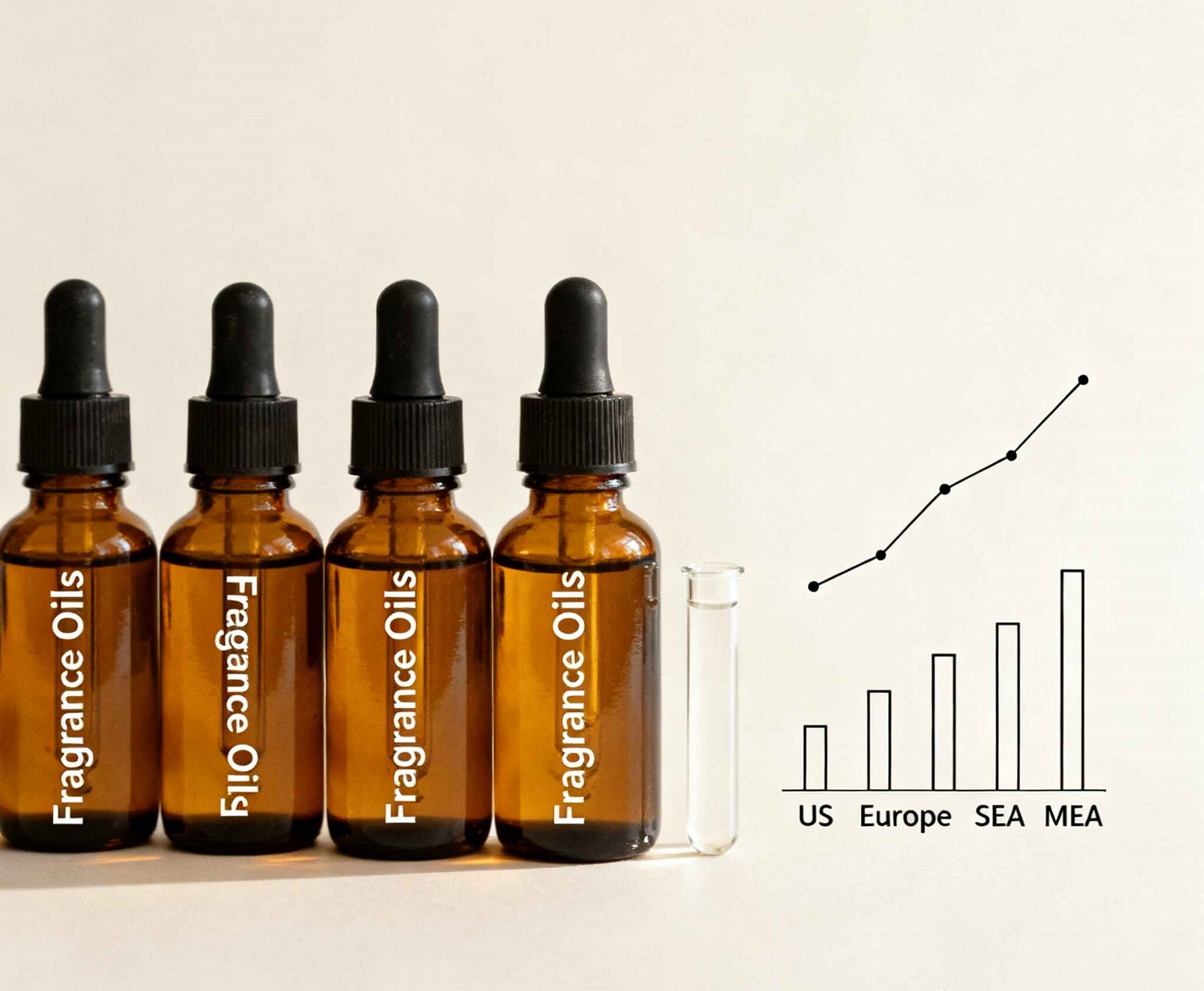

Bottom line: demand for fragrance oils keeps rising, but the why changes by region—US rides prestige growth and gifting, Europe is mid-reformulation under new allergen labelling, Southeast Asia pulls in first-time users through ecommerce and social, and the Middle East doubles down on oil-based rituals and custom builds. Home fragrance and candles keep the engine humming in the background.

If you need a supplier who can move with that curve, I’Scent has you covered: 40,000+ formulas, 20+ senior perfumers, 98% match accuracy, and full IFRA / ISO / GMP / Halal credentials with ERP traceability. Samples go out fast, mass follows quick. Start here: I’Scent or jump to Fragrance Oils.

The US prestige channel kept fragrance at the front of the pack in 2024. Growth held in the high single to low double digits, with gifting windows (Mother’s Day, holiday peaks) doing the usual heavy lifting. Discovery sets and higher-concentration formats (EDP/Extrait) continued to scale.

What this means for oils:

I’Scent note: we’ll provide GC–MS, an olfactive pyramid, and a panel A/B summary when you need to defend a reformulation to a buyer. Explore Fragrance Oils.

Europe’s expanded allergen labelling list is real and timed. New SKUs must comply by July 31, 2026; existing SKUs by July 31, 2028. That pushes brands to map Annex III allergens, update INCI, and, where needed, re-balance accords without losing signature.

Practical workflow (keeps teams sane):

I’Scent runs a “twin + panel” routine so you keep the same story on skin. Kick off via I’Scent and mark the brief “EU 2023/1545” so we route it to the regulatory squad.

Southeast Asia’s curve looks young and lively. Mass fragrance growth in Singapore clocked a healthy uplift (mid-teens), while Vietnam saw stronger double-digit gains off a smaller base. Social content and ecommerce education matter; so do oil/rollerball formats that feel affordable and portable.

What wins here:

I’Scent localises pyramids—think jasmine sambac, mangosteen-bright citrus, modern amber-musk—and ships mini runs so you can test-and-learn without bloated inventories. See Fragrance Oils.

The Middle East keeps its unique mix: oil-based formats (attars, mukhallats), oud signatures, and a strong appetite for bespoke blends. Retail leans on in-store ritual, yet new tools (AR sniffers, guided layering) are showing up in premium doors.

Oil-format implications:

I’Scent carries multiple oud profiles and builds house DNA replicas with a 98% match rate. Brief us at I’Scent.

Home fragrance keeps pulling steady demand for oils. Diffusers, room sprays, and especially container candles consume large volumes once a scent lands.

Technical must-haves:

I’Scent supports candle-grade oils with throw tuning, sooting measurements, and material safety sheets that pass retailer audits. Catalog starts here: Fragrance Oils.

Small grammar moment: it ain’t just trends; it’s behaviors. People test, then they tell friends. Kinda obvious, still easy to miss in planning.

| Region | 2024–2025 signal | Primary drivers | Oil takeaways | What to brief with I’Scent |

|---|---|---|---|---|

| US (prestige) | Fragrance led beauty growth; gifting cycles strong | High concentration, discovery sets | High-load, IFRA Cat 3/4, micro-fill headspace | GC–MS, sillage target, IFRA certificate |

| Europe (EU 2023/1545) | Allergen label expansion; hard deadlines | Reformulation, label updates | Compliance twins, Annex III mapping | Regulatory dossier, artwork copylines |

| SEA (SG/VN focus) | Double-digit lifts; new users | Oil/rollerball, ecommerce education | Humidity-stable, low-stain oils | Localised pyramids, starter sets |

| MEA (oil-first) | Attars, oud, bespoke builds | Rituals + premiumisation | Alcohol-free bases, oud accords | Custom attar kits, optional transparency |

| Home & Candle | Consistent volume pull | Ambience, wellness, gifting | Throw tuning, soot control | Wax-specific validation, burn notes |

| Step | What we need | Why it matters |

|---|---|---|

| 1. Scene /用途 | EDP/Extrait, body, hair, diffuser, candle | Sets IFRA category, dosage bands |

| 2. Guardrails | Allergens to avoid, color spec, clarity | Saves time; avoids re-loops |

| 3. Olfactive goal | Three bullets max (e.g., airy floral, cozy amber, salty vanilla) | Clear direction beats long prose |

| 4. Benchmarks | What to match or avoid (no IP files needed) | Focuses the accord work |

| 5. Ops | MOQ, fill types, timeline window | Aligns compounding + pack |

| 6. Testing | Stability 40/75, freeze–thaw, migration, throw | Stops “surprise fails” downstream |

| 7. Paper trail | IFRA, SDS, COA, allergen list | Retail onboarding without drama |

Ready to brief? Use I’Scent or go direct to Fragrance Oils and mark the form “Layer-Ready” or “EU 2023/1545”.

Compliance isn’t a sticker; it’s a system. We build and document against IFRA, run to ISO and GMP standards, and support Halal routes where needed. Our ERP tracks lots end-to-end so you can answer any QA audit down to a timestamp. If you need a change control trail (ingredient substitution, batch comparison), we’ll export it clean.

Pain point solved: buyers often ask for batch-to-batch Consistency and Annex III proof at the last minute. We package it up front, so your sell-in deck isn’t scrambling.

Sources (unlinked): industry trackers (prestige beauty), regulatory text (EU 2023/1545), regional retail panels (SEA), company segment updates (fine fragrance and beauty), and I’Scent anonymised brief data.

All of the above are live in our library. Ask via I’Scent or browse Fragrance Oils. If you need fragrance duplication for a house DNA, mark the brief “replication 98%” in the notes.

(Yes, a little messy language here and there—on purpose. We keep it human, not robotic.)