Most retail stores don’t lose because the product is weak. They lose because shoppers don’t stay long enough to fall into “I want this” mode. People walk in, scan fast, then bounce. That’s your leak.

Scent can plug part of that leak. Not by blasting perfume into the air. It works when you treat scent like a store system: congruent profile, controlled intensity, clean diffusion, and a test plan you can defend.

If you want to source scent fast and keep it consistent across stores, I’SCENT (I’Scent) can help you build, tune, or replicate a signature smell with speed and tight specs. You can start from the Fragrance Oils catalog and scale from there.

Here’s the simple chain you should remember:

Scent → mood shift → quality perception → approach behavior → purchase behavior

“Smells nice” is not a KPI. What you actually want is approach behavior:

In classic retail field tests, scented environments improved store and product ratings on 7-point scales (think roughly ~4.5 up to ~5.1 in one well-known design). That matters because perception is the pre-sale. People buy what feels “right” without doing a full debate in their head.

So don’t ask, “Do customers notice the scent?”

Ask, “Do customers stay, browse, and buy more smoothly?”

A pleasant scent can still fail if it doesn’t belong. Congruency beats popularity almost every time.

If the scent feels like it belongs in your store, shoppers relax. If it feels random, they get friction. That friction can show up as shorter dwell time, fewer add-ons, and more “just looking” exits.

Use this quick test:

If your scent was a color and a playlist, would it match your store?

If you hesitate, it’s probably not congruent.

Scent doesn’t live alone. In multi-sensory retail tests, matching scent + sound performed better than mismatched pairs. When they clash, it can drag down evaluation. It’s not dramatic. It’s subtle, but subtle is the whole point.

Here’s a simple guide you can use when briefing your team or your supplier:

| Retail keyword | Scent family keyword | What it signals | What to avoid | Typical KPI impact |

|---|---|---|---|---|

| Luxury retail | woody amber, suede/leather, clean musk | premium, depth, confidence | sugary cloud, loud candy notes | conversion, AOV |

| Beauty retail | airy floral, soft musk, “skin-clean” | trust, comfort, safe-to-try | harsh aldehydic bite in small stores | conversion, tester time |

| Athleisure retail | fresh citrus, watery clean woods | energy, clean movement | heavy gourmand that feels sticky | dwell time, zone depth |

| Home lifestyle retail | tea, linen clean, sandalwood-lite | calm, cozy browsing | heavy incense, smoky resins | dwell time, add-ons |

| Mall pop-up | bright citrus, transparent musk | “walk in” pull, clarity | anything too complex or heavy | entry rate, bounce drop |

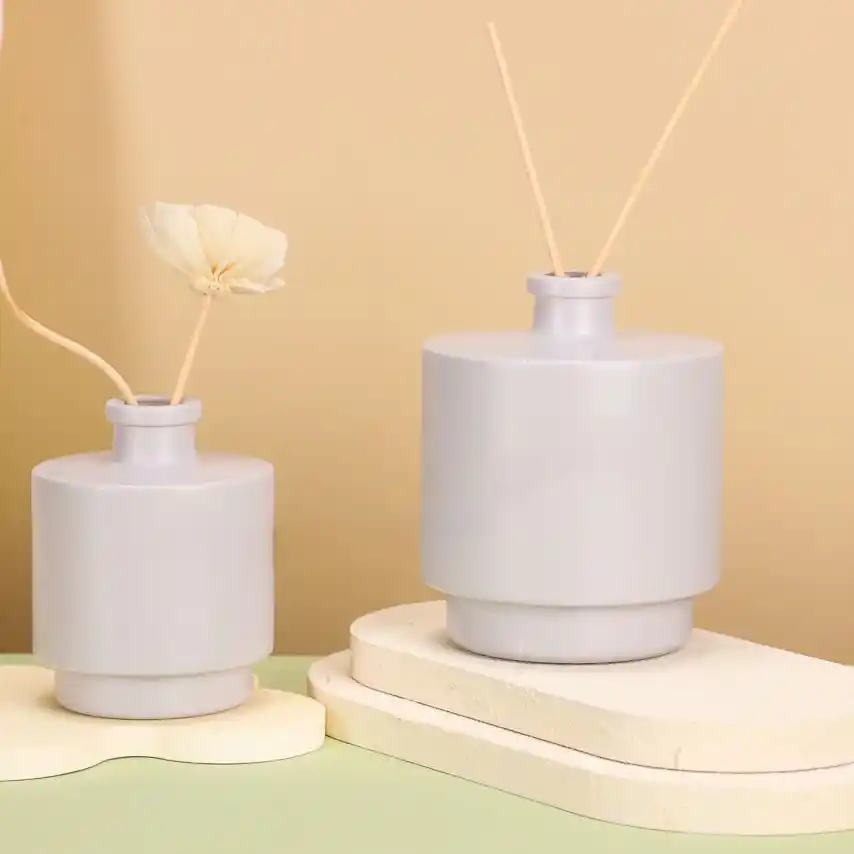

If you need store-air delivery formats, you’ll usually build these profiles in an air care direction. That’s exactly what Air Care Fragrance is for.

Most scent programs don’t fail from the scent choice. They fail from intensity.

If your staff says, “I can’t smell it anymore,” that’s often olfactory fatigue. It doesn’t mean the scent is gone. New customers walking in still catch it.

Too strong creates two problems:

Your target is “barely noticeable, but better.” Not “perfume counter.”

Retail air is messy. Vents steal scent. Return ducts eat diffusion. Doors create pressure swings. If you ignore that, you’ll get hot spots near the diffuser and dead zones everywhere else.

Use zoning like a pro:

If you’re building a branded lobby or a flagship scent environment, look at a hospitality-style approach like Hotel Fragrance and custom lobby scent solutions. Retail and hotel scenting share the same rule: consistency beats drama.

You can’t run scent marketing on vibes. You need a test plan.

Pick one:

Keep variables tight. Don’t change scent and music and lighting all in the same week. That’s how you end up with “We don’t know what worked.”

Track at least:

Also track bounce rate (walk-in to walk-out under 60 seconds). Scent often improves bounce before it improves AOV, and that’s still money.

| Test keyword | Option A | Option B | Measurement | Win condition |

|---|---|---|---|---|

| Scent presence | none | scented | dwell + conversion | lift without complaint jump |

| Congruency | “nice” | category-fit | conversion + AOV | smoother close, fewer bounces |

| Intensity | low | medium | complaints + dwell | medium wins, low irritation |

| Zoning | entry only | entry + core | zone depth | deeper browsing |

| Time-of-day | all day | peak only | conversion | lift at peak traffic |

Some published experiments even show spending can rise without longer dwell time. So don’t panic if dwell doesn’t move. If conversion improves and complaints stay flat, you’re still winning.

Once you find a profile that works, lock it as a signature scent. It’s a brand cue you can deploy across:

The hard part is not creativity. It’s consistency.

If your scent drifts batch to batch, your brand cue breaks. That’s why big teams care about:

I’SCENT runs custom and replication work with 20+ senior perfumers and a 40,000+ formula library, and they claim up to 98% accuracy for scent replication. Sampling can move fast (often 1–3 days), and production can follow quickly (commonly 3–7 days after approval). MOQs can start low for many oils (like 5 kg), while fully custom projects usually start higher. If you need the customization flow, check Perfume Oil OEM/ODM customized services.

If you send your supplier “fresh and luxury,” you’ll get endless revisions. Send a real brief.

Retail teams get stuck on paperwork at the worst time. If you sell globally, you’ll need documentation that supports audits and internal QA. For a clear overview, use Fragrance Oil Safety: SDS/MSDS and COA certifications.

If you want fewer “taste fights” inside your org, standardize your specs. This guide helps: Brand standards and acceptance criteria for fragrance oils.

And if your procurement team asks “Who are we even buying from?”, send them About I’SCENT.

Pick one store type, one goal, and one congruent scent direction. Run a 2–4 week A/B test. Keep intensity low-to-medium and track complaints. You’ll learn more from one clean pilot than ten meetings.

Start with one signature scent for brand recognition. Add zoning later if you have bigger stores or different product areas that feel like mini-worlds (beauty corner vs home corner, etc).

Nope. Too strong can push people out. Medium usually wins, but your HVAC and store size change everything. Tune the “scent throw” like you tune lighting levels.

Yes. Some retail tests show spending can rise even when dwell time stays flat. Scent can reduce friction and make decisions feel easier. That’s still a win.

Keep intensity controlled, log feedback, and rotate peak schedules if needed. Staff is exposed longer than customers, so their tolerance is lower. Also, don’t place diffusers where employees stand all day.

At minimum: IFRA-related info (as needed), SDS/MSDS, COA, and traceability support. Your QA team will thank you, and your global shipments won’t get delayed for dumb reasons.

Ask for scent replication and set acceptance criteria before sampling. If your supplier has a large formula library and senior perfumers, this gets easier and faster.

Retail scent marketing works when you treat it like a system, not decoration. Choose a congruent scent, control intensity, design diffusion around real airflow, then prove it with A/B testing on dwell time, conversion, AOV, and complaints. When the numbers look good, lock it into a signature scent and scale with consistent specs.

If you want a partner that can move fast, hold tight consistency, and support OEM/ODM customization or high-accuracy scent replication, I’SCENT can plug into your retail pipeline without making it a long drama.