You sell fragrance oils. You want launches that don’t slip, OTIF that holds, and fewer “where’s my pallet?” emails. Two cities help you do that without drama: Shanghai and Guangzhou (Nansha). Think of them as a two-engine setup—one for global consolidation and bonded value-add, one for e-commerce speed and RCEP reach. I’ll keep it practical, show real use-cases, and plug in I’Scent where it actually reduces work.

If you’d rather see products first, here’s the front door: I’Scent and Fragrance Oils.

Shanghai isn’t just busy; it’s consistently the world’s top container port by volume. That scale stabilizes mainline sailings and gives you cleaner cutoffs. Yangshan Phase IV—a fully automated terminal—helps shave yard moves and smooth handoffs. Less idle. Fewer surprises. Better ASN discipline.

Why it matters for fragrance oils: Your cartons want predictable windows. Big, steady mainlines reduce roll risk and keep your downstream DC booking plans sane.

Shanghai FTZ gives you “first entering, then declaring” plus bonded warehousing. Bring product into the zone, finish label work, QA release, or repack, then declare and clear. It’s delayed differentiation—perfect for last-minute label language, channel codes, or IFRA paperwork alignment.

Natural fit with I’Scent: we run fast sampling and mass production rhythms, so FTZ buffers make the pace even calmer. If you need a refresher on our scope, see OEM/ODM Fragrance Oil & Perfume Raw Materials Manufacturer.

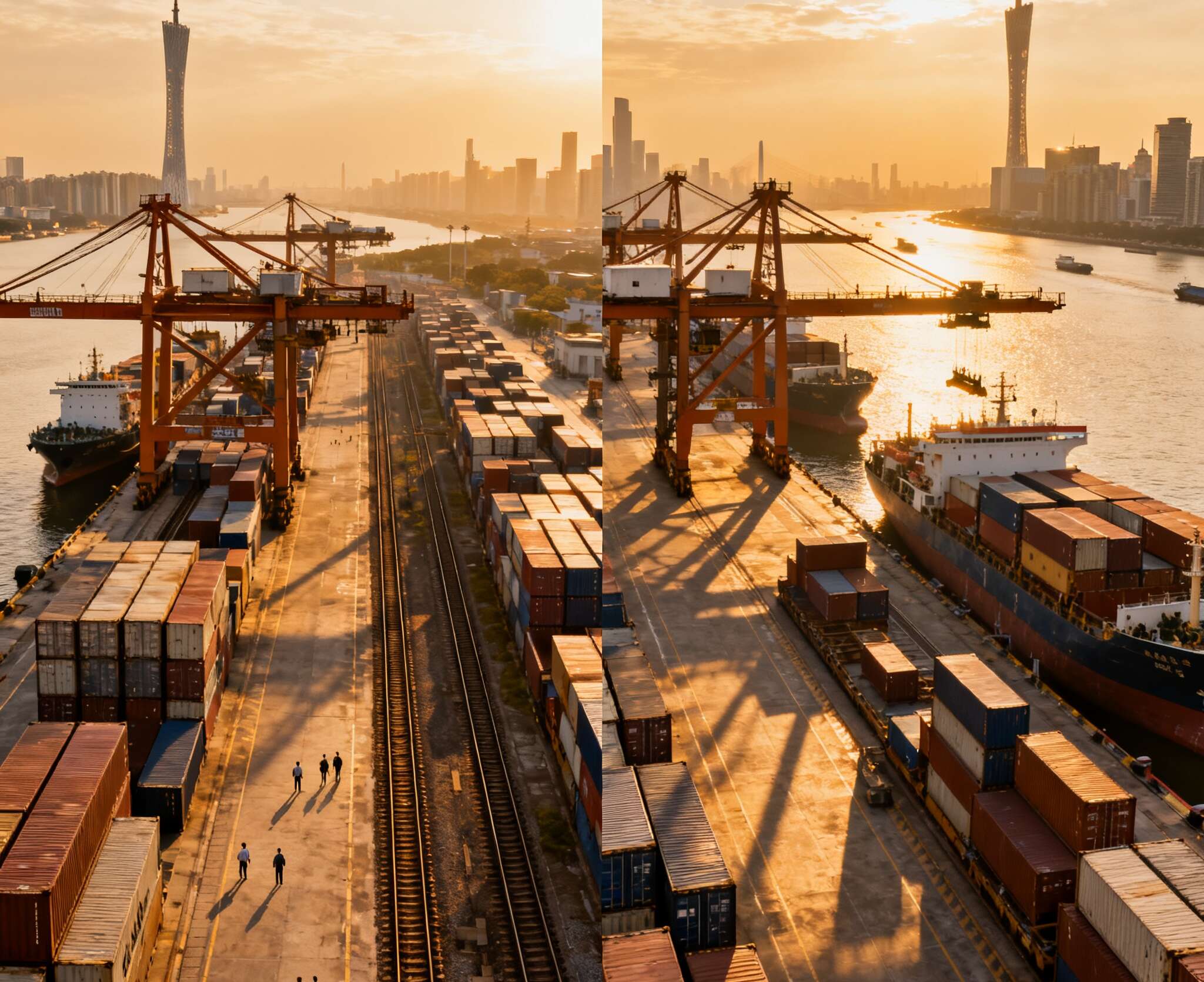

Head south and you hit Nansha, the workhorse of Guangzhou Port. Deep-water berths, growing direct strings to the U.S., EU, and ASEAN, and strong sea-rail into the factory belt around the Greater Bay Area. Nansha’s comprehensive bonded zone also handles heavy cross-border e-commerce volumes—good news if you run marketplace drops or quick seasonal sets.

When a promo date won’t move, air is your safety valve. PVG (Shanghai Pudong) sits among the top global cargo airports year after year. CAN (Guangzhou Baiyun) also ranks in the global top tier. Two heavy hubs, one country. Split uplift by urgency and geography, and keep ocean as the base.

| Topic | Shanghai (Port / PVG) | Guangzhou (Nansha / CAN) | Takeaway for planners |

|---|---|---|---|

| Container throughput | World’s busiest port by annual TEU; stable mainlines | Large-scale deep-water port; direct strings growing | North = backbone; South = speed + proximity |

| Terminal tech | Yangshan Phase IV is a fully automated terminal | Modern berths and yard ops | Fewer yard delays, steadier cutoffs |

| Route network | Dense Asia/EU/US services | Broad routes including ASEAN; strong sea-rail | Fewer re-handles, cleaner inland pulls |

| Air cargo | PVG ranks top globally | CAN ranks top tier globally | Split urgent uplift by lane |

| Trade facilitation | FTZ two-step declaration; bonded ops | Comprehensive bonded zone tuned for e-commerce | Delayed differentiation + quick ex-bond |

| Regional dynamic | China’s east coast consolidation | Greater Bay Area e-com and manufacturing halo | Complementary, not either/or |

Figures vary by year; use the pattern, not the exact count.

Below are repeatable scenes you can copy next week. No imaginary names. No made-up drama.

Where I’Scent fits: we cover Fragrance Oils across fine fragrance, personal care, home scent—fast sample, quick mass, tight traceability.

I’Scent angle: rapid SKU variation is our jam—custom fragrance oil projects move fast when you don’t reinvent the base every time.

Europe & North America

RCEP & ASEAN

| KPI | Why it matters for fragrance oils | Hub lever | Practical nudge |

|---|---|---|---|

| OTIF | Retail penalties and brand trust | Stable mainlines (SHA), direct strings (Nansha) | Lock weekly sailing cadence; stop “hope shipping” |

| Port/FTZ dwell | Cash and freshness | Yangshan automation; two-step declaration | Track gate-in to gate-out, not just ETA |

| Rework rate | Label mistakes hurt returns | Bonded delayed differentiation | Label after PO freeze; use WMS rules |

| Expedite ratio | Air saves launches but burns budget | PVG/CAN split by urgency | Define thresholds; don’t debate case-by-case |

| Traceability | IFRA audits, recalls, retailer onboarding | ERP-bonded integration | Keep batch, COA, SDS in one system |

| Forecast bias | Overbuy = dead stock | FTZ buffer, smaller more frequent builds | Weekly PO commit; 8-week rolling view |

This part isn’t fun. It saves your quarter.

Here’s what we bring so your lanes actually deliver:

(We can sit behind your 3PL/4PL and manage the FTZ paperwork hand-in-hand. No mystery.)

| Use-Case | Best Hub | Levers | Notes |

|---|---|---|---|

| Core B2B launches into US/EU | Shanghai FTZ + mainline | Bonded re-label, two-step declaration, automated yard | Add PVG uplift only for slippages |

| Marketplace drops to ASEAN | Nansha e-com bonded | Direct strings, sea-rail, wave picking | Keep CAN for urgent lots |

| Seasonal gift sets | Split: SHA build + Nansha ship | Late pack-out in FTZ + e-com pick-pack | Avoid over-kitting; control label claims |

| Retailer audits & traceability | Either hub + ERP | Batch COA, IFRA, SDS, GS1 labels | Zero spreadsheet drift |

| New aroma concept pilot | Either hub + I’Scent | 1–3 day samples, 3–7 day mass | Don’t overbuy—lean MOQ |