Most teams still treat fragrance like a one-product decision. Shampoo gets one scent. Dish soap gets another. Air freshener gets something totally different. That sounds “safe,” but it creates a messy brand story. Your shelf looks random, and your R&D calendar gets packed fast.

I’m going to argue the opposite: one strong core accord can (and should) travel across Personal Care, Home Care, and Air Care.

Not as a copy-paste. More like the same outfit, different sizing. Same vibe. Different base.

This is exactly where a Cross-Category Scent Matrix helps. It stops the “we’ll figure it out later” chaos. It also turns fragrance into something you can scale, control, and sell.

And yes, this is where I’SCENT (I’Scent) fits naturally. If you want to build one accord and roll it out across formats fast, you need a supplier who can move from brief → sample → batch without drama. That’s basically the whole point of an OEM/ODM fragrance partner like I’SCENT Fragrance Oils.

People don’t memorize your INCI list. They remember how your products feel and smell. If your brand keeps switching scent direction, you lose “olfactive equity.” That’s the invisible brand asset that makes customers repurchase without thinking.

A reusable accord fixes that. You create one recognizable scent DNA—then let it show up everywhere your customer already lives:

Same signature. More touchpoints.

If you’ve ever poured a beautiful fine-fragrance accord into a detergent base and got “meh,” you already know this. Bases fight back.

So the rule is simple: keep the “recognition points” stable (usually heart + drydown), then tune the parts that crash in each system (often top + boosters + fixatives).

Here’s the matrix I use when I’m building one accord across three categories. Print this, stick it on your lab wall.

| Category keyword | Base system reality | What stays the same (brand DNA) | What you tune (formulation levers) | Performance KPI (real-world) | Common failure mode (lab slang) |

|---|---|---|---|---|---|

| Personal Care Fragrance | surfactants, cationics, emulsions, silicones | heart notes + drydown “skin memory” | solubilization, discoloration risk, cationic compatibility, allergen gating | “wet sniff” in shower + drydown on hair/skin | fragrance crash / haze / off-tone |

| Home Care Fragrance | high pH, oxidizers, enzymes, strong solvents | cleanliness signal + recognizable drydown | alkali stability, bleach tolerance strategy, malodor strategy, cost-in-use target | scent on fabric + in-room aura after cleaning | pH twist / chemical burn / “flat” |

| Air Care Fragrance | diffusion, heat, carrier solvents, plastics | signature trail (sillage in space) | diffusion curve, hot/cold throw, adsorption control, longevity | time-to-nose + 2-week stability | top-note blow-off / plastic uptake |

Now let’s make this practical with real product examples that already exist on your site.

If you sell Personal Care, you’re not just selling “smells good.” You’re selling trust. People put it on skin. They use it daily. If the scent shifts batch to batch, they notice fast.

For category structure and product ideas, see: Personal Care Fragrance.

Personal care bases are tricky because they look clean and simple, but they’re full of interactions:

A scent that’s gorgeous in alcohol might haze out in a clear shampoo. Or it might bind to quats and lose lift. That’s why perfumers talk about base compatibility, not just smell.

A clean musk accord is one of the easiest “bridge accords” across categories, because people read it as hygiene + comfort.

You already have a ready example:

Conditioner-Safe White Musk Personal Care Fragrance Oil

What makes this type of accord travel well:

Now here’s the cross-category move:

Keep that same clean musk DNA, then push it slightly depending on the scenario:

Same family. Different outfit.

Home care is where fragrance becomes a proof-point. Consumers don’t just want “clean.” They want the smell to confirm clean.

For your category and formats: Home Care Fragrance.

Home care bases can be harsh. Detergents and cleaners run into:

So your cross-category accord needs stability plus a malodor strategy. And no, “masking” isn’t enough if the base stinks. In industry talk, you need your fragrance to carry a decent counteract profile.

Citrus is classic in dishwashing because it reads as “cuts grease.” But citrus can be fragile. It can also smell thin if the base suppresses it.

You already have a great anchor product for this:

Dishwashing Liquid Citrus Burst Home Care Fragrance Oil

How to reuse that same citrus accord across categories without it feeling random:

This is where a matrix saves you time. You don’t invent a new scent. You tune the same DNA to match the base and the room.

Air care is pure performance. If it doesn’t throw, it doesn’t sell. Simple.

For your category formats: Air Care Fragrance.

Air care comes down to physics:

So when people say “use the same fragrance,” what they really mean is:

use the same olfactive story, but redesign the delivery curve.

You already position this clearly on your site:

Candle Fragrance Manufacturer (Air Care)

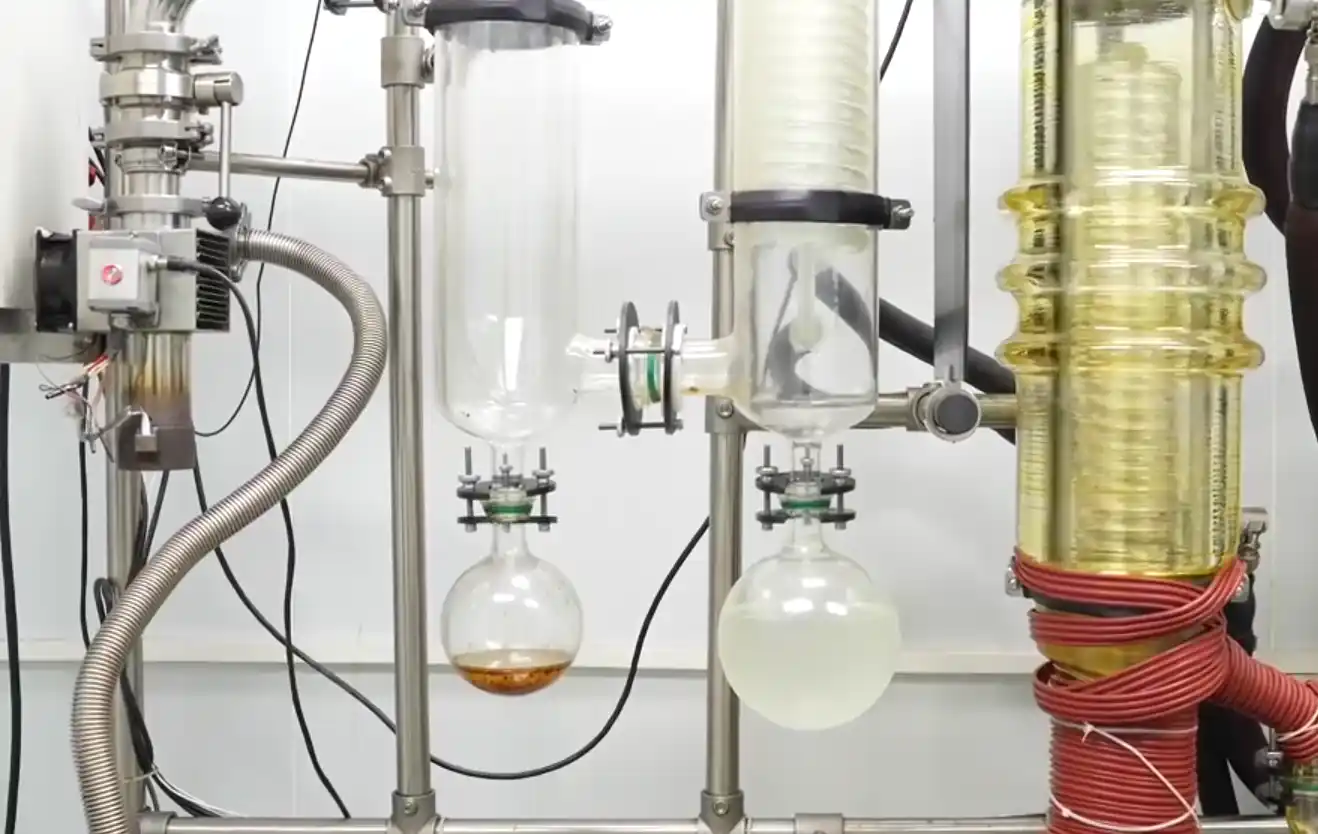

Candles are a great test bench for cross-category accords because they punish weak construction. If the accord collapses under heat, you’ll know quick.

If your core accord performs in candle wax, you can usually adapt it to:

That’s not theory. That’s just how labs survive.

Cross-category work fails most often on paperwork, not smell. For real.

If you reuse one accord across three categories, you must manage:

This is a big reason brands prefer a supplier that already runs the “compliance muscle” daily.

I’SCENT’s positioning matters here: IFRA, ISO, GMP, Halal, plus ERP traceability and tight batch consistency. It’s not sexy copy. But it prevents recall headaches, and it makes approvals smoother.

Let’s be blunt. A reusable accord strategy is about growth, not just scent.

When you reuse one accord smartly:

That’s “fragrance architecture” doing its job.

Here’s a capability snapshot that supports that rollout model:

| What you need for a cross-category roll-out | Why it matters | I’SCENT fit (from your site info) |

|---|---|---|

| Big formula library | faster starting point, fewer dead-ends | 40,000+ formulas |

| Senior perfumers | better tuning knowing base behaviors | 20+ senior perfumers |

| High match accuracy | faster clones + faster market response | up to 98% scent replication accuracy |

| Fast sampling | speed wins shelf windows | samples in 1–3 days |

| Fast scale-up | stops “lab win, factory fail” delays | mass production in 3–7 days |

| Low MOQ | lets you test before you go big | low MOQ options + custom MOQ path |

| Certification + traceability | de-risks audits, supports global sales | IFRA / ISO / GMP / Halal + ERP traceability |

If you want the service flow in one place, this page lays it out clean:

Perfume Oil OEM/ODM Solutions

Here’s the practical playbook I’d run with I’SCENT. Nothing fancy.

If you want to browse the full category mix before you pick your base accord direction, start here:

I’SCENT Fragrance Oils